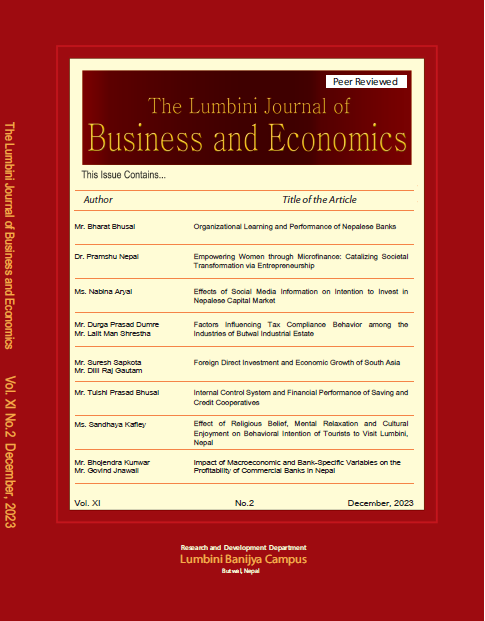

Effects of Social Media Information on Intention to Invest in Nepalese Capital Market

DOI:

https://doi.org/10.3126/ljbe.v11i2.64718Keywords:

Capital Market, Investment Intention, Social Media InformationAbstract

The study has aimed to utilize the Theory of Planned Behaviour (TPB) to understand the investment intentions of potential individual investors in Nepal and explore the implications of online social media on their inclinations to invest in the capital market. The data were collected from 383 respondents through scheduled questionnaires and analyzed using the Statistical Package for the Social Sciences (SPSS), the study finds subjective norms, preference for innovation, risk-propensity, and perceived risk positively influence investment intention, however, attitude towards information has no effect on investment intention. The findings provide valuable insights for investors in Nepal to consider subjective norms, innovation preferences, risk propensity, and perceived risk when making investment decisions in the capital market.