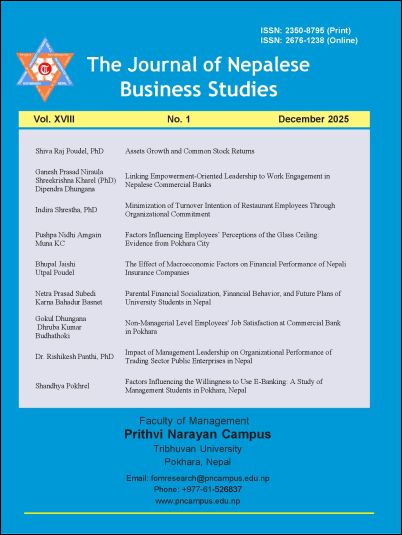

The Effect of Macroeconomic Factors on Financial Performance of Nepali Insurance Companies

DOI:

https://doi.org/10.3126/jnbs.v18i1.90492Keywords:

Macroeconomic factors, insurance companies, financial performance, ROA, ROEAbstract

This study looks at the impact of a few macroeconomic variables on the financial performance of Nepalese insurance businesses as determined by return on equity (ROE) and return on assets (ROA). These variables include the money supply, GDP growth rate, inflation rate, interest rate, and exchange rate. Six life and six non-life insurers that were listed on the Nepal Stock Exchange throughout a 12-year period (2013 to 2024) provided secondary data for the study. Multiple linear regression analysis was conducted using EViews software to assess the impact of the macroeconomic variables on profitability. The results show that, except for exchange rate, which has a significant effect at the 10 percent level, macroeconomic factors including inflation, GDP growth, interest rate, and money supply do not significantly influence ROA or ROE. The findings provide empirical evidence of the limited effect of macroeconomic conditions on the financial performance of Nepalese insurance companies and offer insights for policymakers and investors regarding macroeconomic risk.

Downloads

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2025 Journal of Nepalese Business Studies

This work is licensed under a Creative Commons Attribution 4.0 International License.

This license allows reusers to distribute, remix, adapt, and build upon the material in any medium or format, so long as attribution is given to the creator. The license allows for commercial use.